Invest in your future

We teamed up with Climb Credit, an education loan provider, to make our Cloud Mastery Bootcamp accessible through payment options that are affordable, fast and easy.

Affordable and flexible payment options

We firmly believe that education is the most valuable investment you can make.

Invest in your future today and advance your cloud career.

Instant decision

Your application takes no more than 5–minutes and just applying will not impact your credit score. Climb only performs a hard credit pull when the loan is funded.

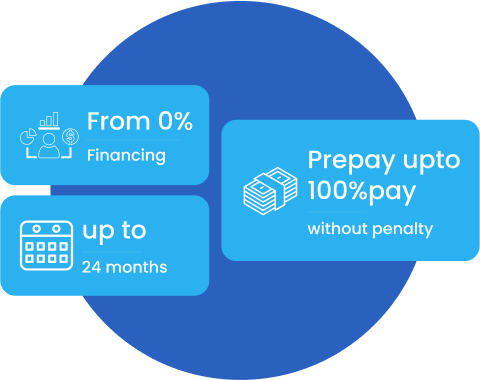

Spread your tuition costs over up to 24 months

Ease the burden of immediate financial commitments. Invest in your future at a pace that suits your financial situation. No pre-payment penalty.

0% financing options

Eligible students enjoy interest free financing options with 0% interest for the term of the loan.

Eligibility

You are a US citizen / permanent resident

Student loans are only available to US citizens and permanent residents. Non-US residents can apply with a co-borrower who is a US citizen or permanent resident.

If under 18, a co-borrowers is required

If you’re under the legal age of majority in your state, you can work with us as long as you apply with a co-borrower who is of the legal age or older.

Strengthen your application

If you’d like to increase your chances of approval, you can also apply with a co-borrower (any person willing to pay if you can’t). This may even lead to a lower interest rate!

Eligibility

You are a US citizen / permanent resident

Student loans are only available to US citizens and permanent residents. Non-US residents can apply with a co-borrower who is a US citizen or permanent resident.

If under 18, a co-borrowers is required

If you’re under the legal age of majority in your state, you can work with us as long as you apply with a co-borrower who is of the legal age or older.

Strengthen your application

If you’d like to increase your chances of approval, you can also apply with a co-borrower (any person willing to pay if you can’t). This may even lead to a lower interest rate!

What you can expect

A quick online application, which can be completed in as little as 5 minutes with no impact on your credit score.

You get access to a simple, secure, online account through which you can upload documents, view your status, and take on your application.

Frequently Asked Questions

Who is Climb Credit?

Climb Credit is a new kind of student lending company that focuses on financing career-building programs. They believe education is an investment toward your future career and earning potential and provide loans to help you reach that potential. They work only with schools that provide career-building, skill-based education.

How does the process work?

The Climb Credit loan process is simple and fully online. You can complete a Climb Credit application in as little as 5 minutes, and the vast majority of their applicants receive a funding decision immediately.

Does applying for a loan impact my credit rating?

To check the rates and terms you qualify for and your eligibility, Climb Credit conducts a soft credit pull that will not affect your credit score. This means you can apply multiple times with multiple co-borrowers until you get the best rate.

Do I need a co-borrower to take out a Climb Credit loan?

Having a co-borrower isn’t required, but you may end up with a lower interest rate if you do decide to apply together with a co-borrower. Adding a co-borrower can also increase your chances of getting approved.

What will my interest rate be?

How do I make loan payments?

What happens if I’m unable to make a payment?

Climb Credit is there to help! They offer payment deferment options for qualifying borrowers. Just reach out to their team to learn more.

When do I start making my monthly payments?

Your first payment is due one month after your loan is funded by Climb Credit.

What happens if I get denied for a Climb Credit loan?

If your application is denied, you will be asked to re-apply with a co-borrower. In this case, you’ll receive a separate email with more information.

How do I contact Climb Credit’s support team?

If you have any additional questions about Climb Credit or their application process, you can reach out to Climb’s Student Success Team through live chat at their website (climbcredit.com) or email at hello@climbcredit.com. Their team is available 10 am–8 pm ET, Monday–Friday.

Have more questions?

For further information, reach out to a Climb representative.